‘Pricing everyone out of the American Dream’: Wildfire risk causes insurance distress for Central Oregon homeowners

Claire Elmer

(Update: adding video, comments by insurance agent, homeowner)

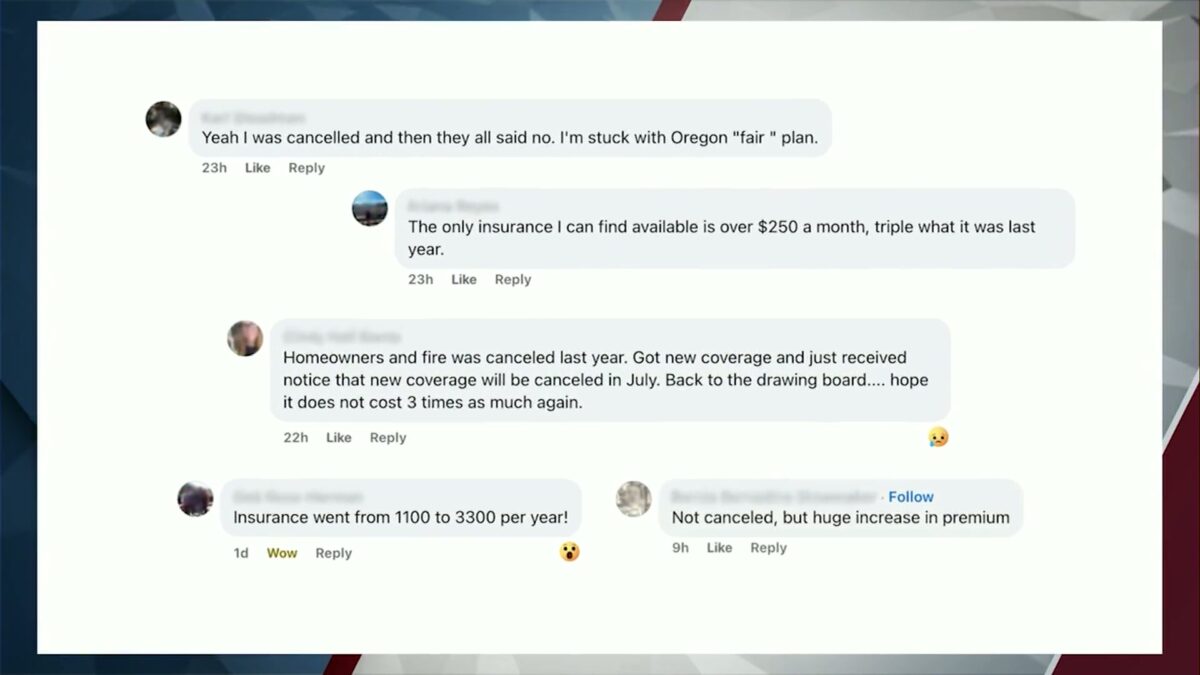

BEND, Ore. (KTVZ) — From staggering rate increases to notices of cancellation, a large number of homeowners in Central Oregon are being greatly affected when it comes to their home insurance.

Residents of La Pine have taken a particularly hard hit. Many are being faced with reduced coverage, astronomical price increases, or not being able to obtain a policy at all.

With some rates doubling or tripling, homeowners are concerned about how they’ll be able to make ends meet. We spoke with La Pine homeowner Heather Post, who shared her experiences.

“We’re pricing literally everyone out of the American dream,” Post said. “Almost one-third of my husband’s income goes to just property tax and home insurance. I’m also paying $400 more a year because I didn’t give them a lump sum. If you wanted a lump sum, you probably shouldn’t have raised it three times, four times its rate,”

Especially for those on a fixed income, concerns about how they’ll be able to stay in their homes are looming larger each year. Reducing fire coverage is a risk many are too fearful to take, making some residents feel they may have to leave the area entirely to find financial relief.

“We get into a house, we’re comfortable with our bills. And then hikes keep happening, and it prices people out. Then our one safe place, our one happy paradise, gets taken from us,” Post said.

While insurance companies are legally not allowed by state law to use the highly contested state wildfire risk map to determine rates or coverage, customers felt there was a correlation between its release and their increase in insurance issues. We spoke with one local insurance agent to find out more.

Chris Schalker of Country Financial told KTVZ News, “it’s kind of the wild West when it comes to insurance right now. Rates are going up everywhere across the country, especially in areas with more forest density, (but) the new state map has no effect on whether or not we will write a policy, or not renew somebody.”

We asked what recourse people have, if they are faced with a cancellation or startling increase. Finding a local insurance agent who can meet with you about your specific home and potential alterations you can make to your property or policy was at the top of the list.

“I would recommend reaching out to your insurance agent and finding out where there might be opportunities for them to lower their rates and get themselves in a better place…as long as there’s options available and people are educated, I think we can weather the storm,” Schalker said.

If you are struggling to find coverage, you could be eligible for a policy through the Oregon Fair Plan Association. You can also receive a free ‘defensible space’ assessment of your property by the Oregon State Fire Marshal.

Though a simple solution may not yet be in sight, we will keep you updated with any new, useful information.