Deschutes County assessor holds informational meeting about 2025-26 property taxes

Spencer Sacks

(Adding Video and Quotes from Deschutes County Tax Assessor Scot Langton)

BEND, Ore. (KTVZ) — Property Tax Statements have been sent out but now people have questions.

Deschutes County tax Assessor Scot Langton and Deschutes County held an informational session on Monday for residents and home owners to be able to ask questions about their property taxes.

When you look at your tax statement you’ll see a breakdown of where your taxes go: county library, law enforcement, and urban renewal.

But if you look at the bottom, you’ll see a list of bonds that were passed by residents of Deschutes County.

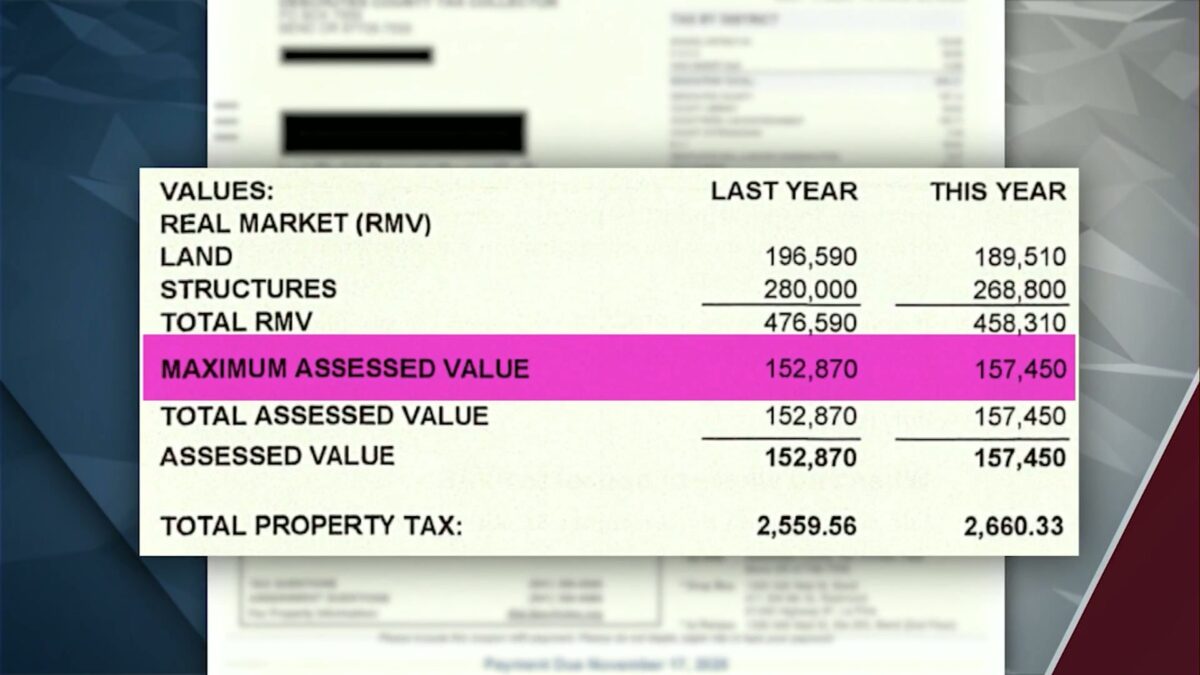

Due to a law passed by voters changing the state’s Constitution, your maximum assessed value of your property can only increase by 3% each year.

KTVZ spoke with Deschutes County Tax Assessor Scot Langton to get a better understanding.

Langton told KTVZ News, “Mostly it’s because of the Constitution and Ballot Measure 50, and they’re paying on their maximum assessed value, which grows 3% annually. Then we apply the tax rates to that. We do vote in new things, so your taxes could go up by more than 3, most people say around 4%.

If you pay your property taxes by November 17th, you can get up to 3% off your property taxes.

Taxes can be very confusing, but Langton told me they have staff and assessors available to answer any of your questions.

The last one of these info sessions is tomorrow night at 5 PM in Sisters.