Department of Justice takes case alleging federal fraud by Columbia businessman

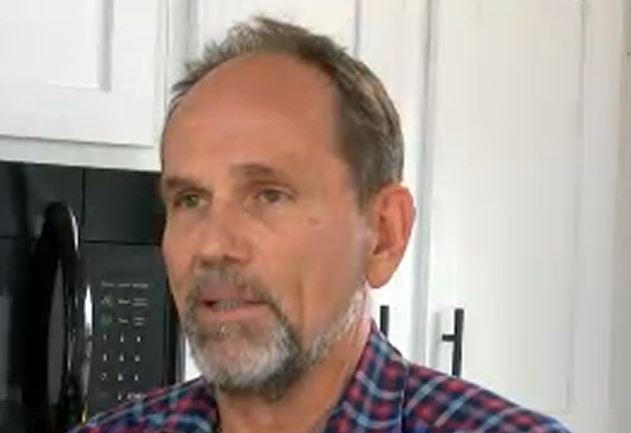

Lucas Geisler

COLUMBIA, Mo. (KMIZ)

The Department of Justice will begin handling claims of a Columbia businessman misusing a pandemic-era relief plan — an allegation he denies.

Federal attorneys unsealed the case on Oct. 7 against Greg DeLine and three of his companies — GKD Management, Midwest Mortgage Association and Amega Sales. The DOJ is considering whether DeLine violated the False Claims Act through numerous Paycheck Protection Program loans he received in 2020.

The case stems from a complaint made in 2020 by Columbia attorney A.W. Smith to the federal government. Smith filed the suit as a “qui tam” case against DeLine under the False Claims Act. The Federal Bar Association describes such cases as allowing “whistleblowers to take legal action on behalf of the government.” The whistleblower can collect a portion of any money the government collects if successful.

DeLine told ABC 17 News on the phone Wednesday that he expected the case to end in a repayment plan to the federal government. DeLine denied that any fraud took place, but declined to comment further on the case.

Smith said he first suspected the fraud when he and DeLine had business conversations that included the number of people DeLine employed. Smith said DeLine told him many of his more than 400 workers were “1099 employees,” or independent contractors at his trucking or mobile home businesses. Small Business Administration rules prohibited employers from including independent contractor payments in their loans.

Records from ProPublica show DeLine had a $5.8 million loan forgiven through the PPP. Amega Sales received a $242,647 loan forgiven, GKD Management had $454,400 forgiven and Midwest Mortgage Associates had $794,200 forgiven, all for payroll expenses.

Smith said each business applied for PPP loans with hundreds of employees, which would have made DeLine one of the largest employers in Boone County. Smith said he felt DeLine was “double-dipping” on PPP loans.

Smith, through his attorney Joe Kronwaitter, declined to comment on the case.

Assistant prosecutor Matthew Sparks said the DOJ would accept the case and planned to file an amended complaint in the next 60 days. ABC 17 News received an automated reply from the U.S. Attorney’s Office saying questions outside “national security, violations of federal law, and essential public safety functions” would be answered after the federal government shutdown.

Qui tam actions have been used before in PPP fraud cases. The prosecutor’s office in New Jersey announced a $13 million settlement with three companies after receiving a qui tam complaint. The DOJ announced a $21 million settlement with three Chinese companies over PPP concerns following a similar complaint.