New law increases HOA transparency, gives homeowners more foreclosure protections

Michael Logerwell

COLORADO SPRINGS, Colo. (KRDO) – On October 1, homeowners living with Colorado HOAs (homeowner associations) were given new legal protections due to a new state law.

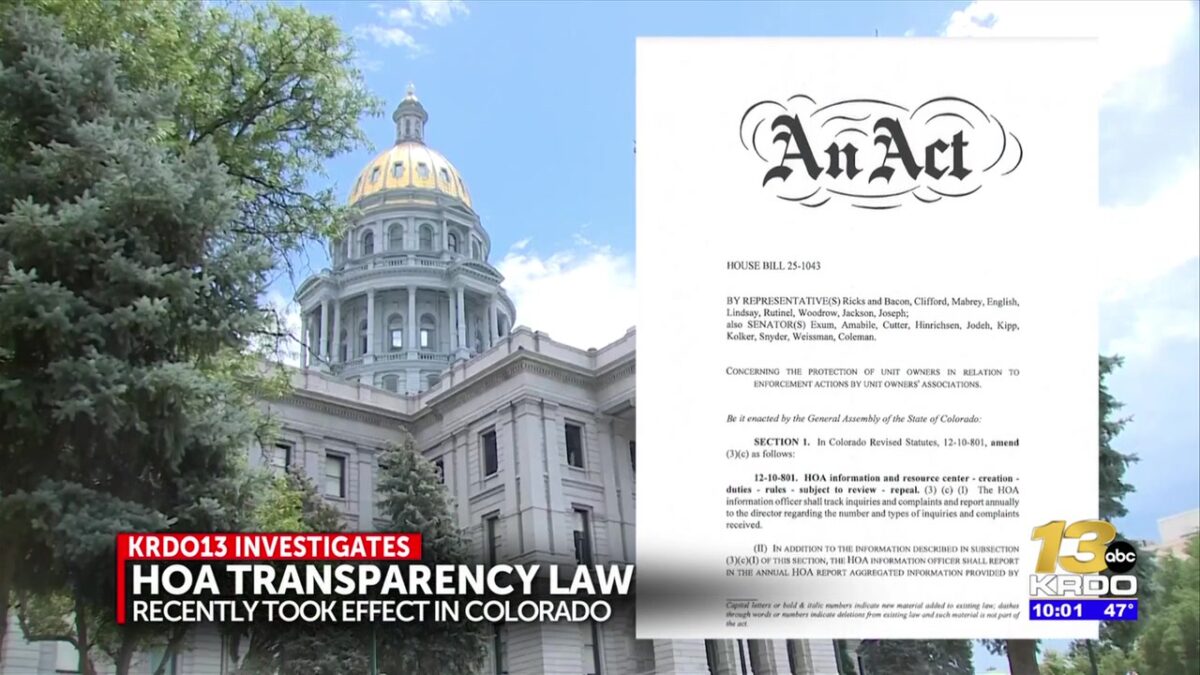

The Owner Equity Protection in Homeowners’ Association Foreclosure Sales, or HB25-1043, aims to protect homeowners in HOAs through two main avenues:

Increasing transparency and state regulation

Preventing or delaying home foreclosures

“Homeownership is one of the primary ways for families to create generational wealth, and under the current system, HOA fees can strip homeowners of everything they’ve worked for,” Senator Tony Exum (D), who represents parts of Colorado Springs, told KRDO13.

Senator Exum, along with representatives Naquetta Ricks and Jennifer Bacon, were prime sponsors of the bill.

“[The law] requires the HOA to provide clear and timely notices about outstanding balances, as well as information about free resources, regarding HOA collections and foreclosures,” Sen. Exum said. He added that now HOAs will have to report annual data to the Colorado Department of Regulatory Agencies (DORA) on delinquencies, judgment payment plans, foreclosures, and more.

Speaking of foreclosures, Sen. Exum says this new law will prevent homeowners from having the rug, floor, and foundation pulled out from underneath them.

“HOA foreclosures are on the rise and have been on the rise for a long, long time,” Sen. Exum said.

“Colorado HOA homeowners, especially in my district [in Denver], have had their largest asset taken from them and sold at an auction for a fraction of its worth over sometimes very small amounts owed to the HOA,” said Assistant Majority Leader Jennifer Bacon (D), who represents parts of Denver.

The new law will allow homeowners faced with foreclosure by their HOA to delay the foreclosure sale. To take advantage of this new provision, owners of the home or unit would have to file a motion with the court to delay the auction date and allow the owner to sell the property themselves. The delay could last up to nine months.

In theory, this would allow owners to recoup some of the money that they’ve put into their home, pay off HOA fees, and give them something to rebuild with.

But some homeowners are skeptical about how this new law will work in practice.

Heather McBroom first contacted KRDO13 Investigates when she and her neighbors were faced with a special assessment fee of up to $20,000 from their HOA.

“I think it’s a great start to a very complicated problem,” McBroom said.

However, McBroom expressed concern about the new transparency regulations being put into practice. “How many HOA governing documents are not going to match the current laws or haven’t been updated, such as ours hasn’t been updated in 20-something years?” McBroom asked. She also wondered if new regulations would result in higher fees from management companies.

As for the foreclosure delays, “First off, being able to notify the homeowner that a foreclosure is coming, I think, is super important. Being able to give them advice on credit, [and] companies that may help them.”

“If you don’t have money to pay an assessment, do you have money to first and foremost petition the court to ask to be able to sell your property? And then you have nine months to do so. Do you have the money to do the fixing of anything that needs to be fixed?” McBroom asked.

McBroom says this law is a step in the right direction and is still excited about state leaders creating more laws to protect homeowners, and hopes their next targets are around training HOA boards so they’re not as reliant on management companies.

As for the Soaring Eagles HOA, the legal team representing several homeowners gave KRDO13 Investigates the following statement:

“On September 22, 2025, the Soaring Eagles Townhomes Association, Inc. filed a lawsuit in El Paso County District Court against certain homeowners in the community. The Association is asking the court to decide whether it has the right to charge each homeowner a special assessment of $20,752.12.Robinson & Henry, P.C., represents several of the affected homeowners in this case. The parties have agreed that our clients will have until October 31, 2025, to respond to the Association’s complaint. They have also agreed to pause collection of the assessment for our clients while the case is pending, meaning our clients will not have to pay the amount—or face any penalties or interest—until the litigation has been resolved.”