Columbia moves forward with Public Safety Sales Tax plans; city officials say funding has been an ongoing issue

Olivia Hayes

COLUMBIA, Mo. (KMIZ)

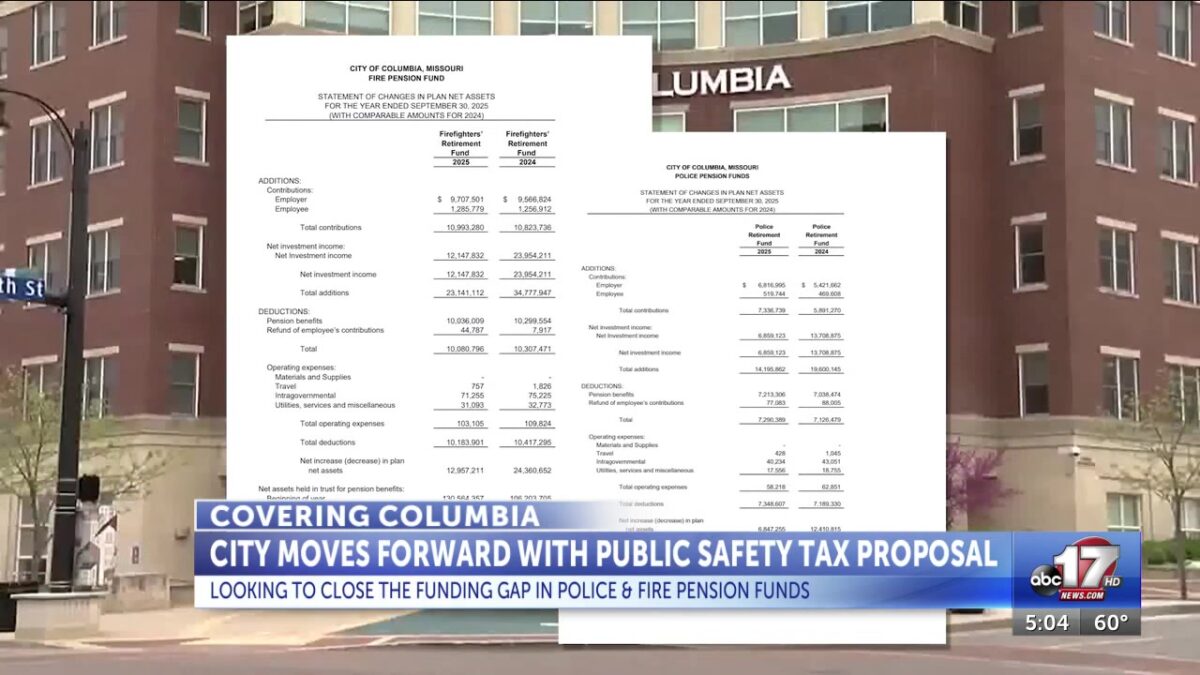

The Columbia City Council is moving forward with its plans for a proposed 1% Public Safety Sales Tax it believes will help close a $156 million funding gap in the Columbia Police and Fire retirement fund.

The police pension has a $66 million funding gap with nearly $81 million currently in the account. While the fire department has a nearly $90 million funding gap with just under $144 million in its account.

The police and fire pension fund grew 50% fewer in fiscal year 2025 than it did in fiscal year 2024. The city believes the 1% sales tax would bring in an additional $38 million for public safety departments by fiscal 2028. That money would go into a separate and dedicated account; public safety departments would also still receive about $60 million in general revenue funds.

Matt Nichols, President of the Columbia Police Officers Association, claims the problem started in 2012, when the pension plan was last changed.

“By 2032 the goal is to have the pension funded to 80%,” Nichols said. “We are now 14 years into this plan and we have lost almost 20% of funding out of the police pension.”

Nichols said officers accepted fewer benefits up front with the promise of retirement stability.

“We are now eligible [to retire] at 25 years of service,” Nichols said. “Instead of receiving 60% of our salary, now we only receive 50% and our contribution has increased by almost 2%.”

Randy Minchew, a member of Columbia’s Finance and Audit Committee, claimed years of the city not properly funding the account’s deficit has snowballed the issue.

“The money that sits in that pool is supposed to be earning a certain amount of money and everything that it doesn’t earn the city is supposed to pay. The city got used to funding in a certain amount,” Minchew said. “We’re not putting enough funds in because surely this is going to turn around, surely we’ll get back to where we were, right? But we don’t and we’re not going and now and now it’s too low.

Columbia has the seventh-highest sales tax rate out of the most populated cities in the state, sitting at 7.975%. The new tax would make it the fourth-highest sales tax rate at 8.975%.

The tax increase would have to be passed with a vote by Columbia residents. If discussions go as hoped, the issue could be on the August ballot.