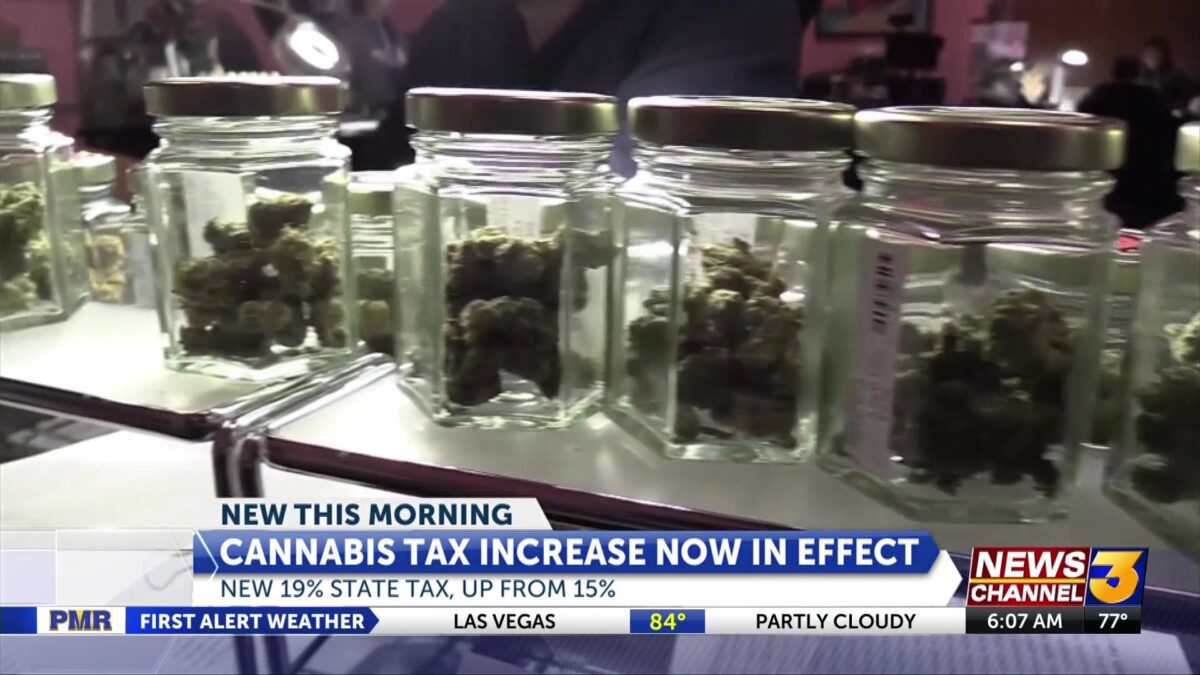

New California excise tax raises prices of legal cannabis products

Kendall Flynn

CATHEDRAL CITY, Calif. (KESQ) – Californians will now pay more for legal cannabis products after a new state excise tax took effect July 1. The 19% tax represents a 4% increase from the previous 15% rate.

Double Eye Dispensary in Cathedral City said it has been preparing customers for the tax increase, by letting them know after every purchase – leading up to the start date – that their purchases would cost more in July.

While the dispensary said the tax doesn’t impact them directly, they are concerned for the consumer. Many of their customers are on fixed incomes and use the dispensary for medicinal purposes. They now worry those customers won’t be able to afford their products or will go to unlicensed sellers.

Kevin Lopez, with the Double Eye Dispensary, said buying marijuana from unlicensed sellers can be dangerous because it is not a tested product. The customer no longer knows if the cannabis is safe from pesticides or other harmful chemicals.

Stay with News Channel 3 to hear from Double Eye Dispensary and customers on how this could impact their wallets or ability to purchase.